COUNT

Nearly 2 in 10 in APAC embrace digital payments during pandemic

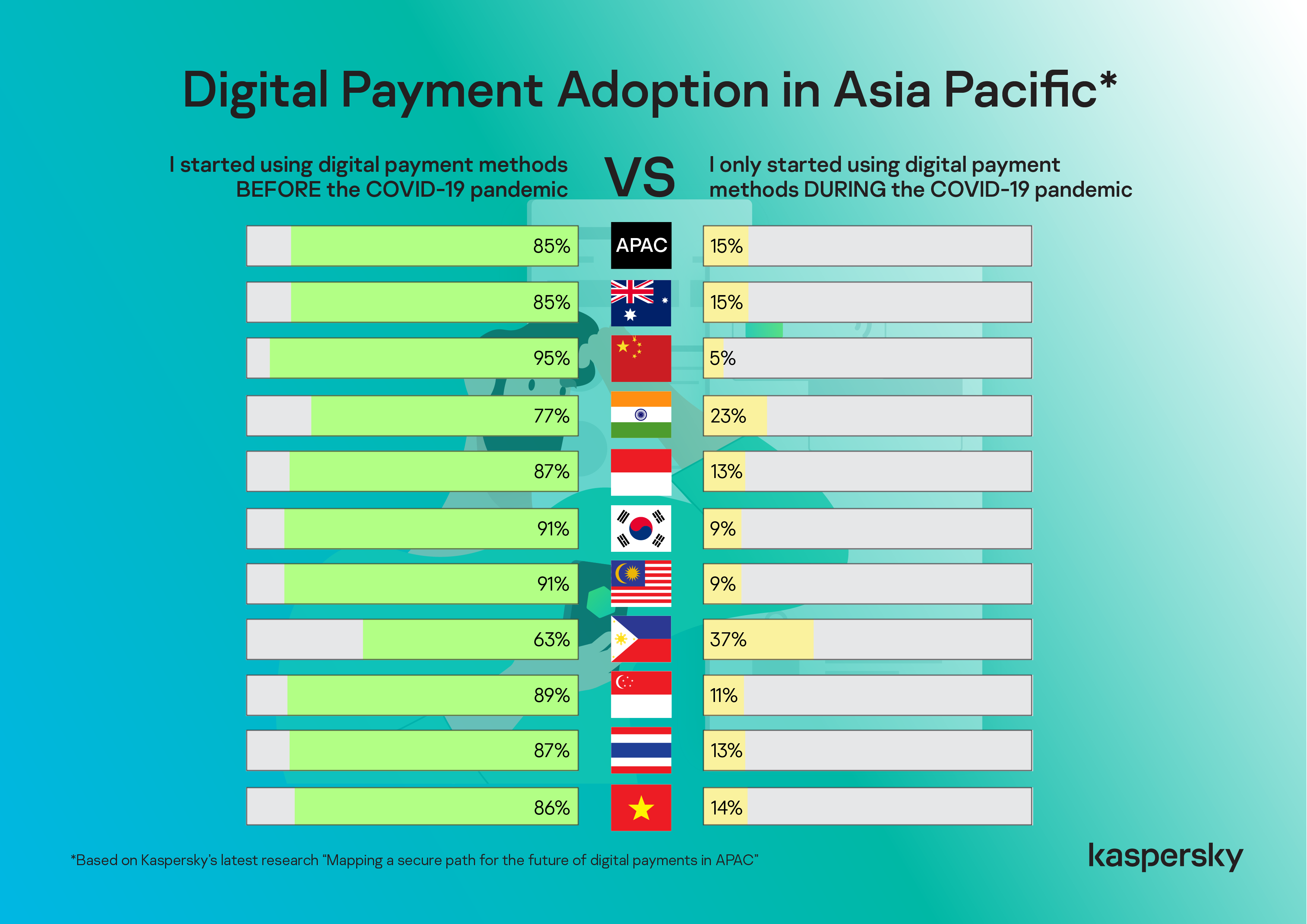

IS cash still king in the Asia Pacific?Kaspersky’s recent study showed it still is, but may not be for long.Titled “Mapping a secure path for the future of digital payments in APAC”, the research studied local users’ interactions with the available online payments in the region and examined their attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology.One of its key findings showed that a great majority (90%) of the Asian respondents has used mobile payment apps at least once in the past 12 months, confirming the fintech boom in the region. Nearly 2 in 10 (15%) of which only started using these platforms after the pandemic.The Philippines logged the highest percent of new e-cash adopters at 37%, followed by India (23%), Australia (15%), Vietnam (14%), Indonesia (13%), and Thailand (13%). The lowest number of first-time online payment users are China (5%), South Korea (9%), and Malaysia (9%).China has been a notable leader in mobile payments in APAC. Even before the pandemic, its top local platforms, Alipay and WeChat Pay, have witnessed significant mass adoption and served as an example to follow for other Asian countries.“Data from our fresh research showed that cash is still king, at least for now, in APAC with 70% of the respondents still using physical notes for their day-to-day transactions. However, mobile payment and mobile banking applications are not far behind with 58% and 52% users utilizing these platforms at least once a week up to more than once a day for their finance-related tasks. From these solid statistics, we can infer that the pandemic has triggered more people to dip their toes into the digital economy, which may fully dethrone cash use here in the next three to five years,” says Chris Connell, Managing Director for Asia Pacific at Kaspersky.Safety and convenience triggered more users in APAC to embrace financial technologies. More than half of the survey pollees noted that they started using digital payment methods during the pandemic as it is safer and more convenient than making a face-to-face transaction.

Respondents also cited that these platforms allowed them to make payments while adhering to social distancing (45%) and that these are the only way they can do monetary transactions during the lockdown (36%). For 29% of users, digital gateways are more secure now compared to pre-COVID-19 era and the same percentage also appreciate the incentives and rewards providers offer.

While only a small fraction, friends and relatives (23%) still influenced new adopters as well as the local government (18%) promoting the use of digital payment methods.

When asked about their reservations prior to using mobile banking and payment apps, first-time users admitted their fears – afraid of losing money online (48%) and afraid of storing their financial data online (41%). Almost 4 in 10 also revealed they do not trust the security of these platforms.

More than a quarter also find this technology too troublesome and requires many passwords or questions (26%), while 25% confessed their personal devices are not secure enough.

“To drive a secured digital economy forward, it is important for us to know the pain points of our users and identify the loopholes that we need to address urgently. It is a welcome finding that the public is aware of the risks that comes with online transactions and because of this, developers and providers of mobile payment applications should now look into the cybersecurity gaps in each stage of the payment process and implement security features, or even a secure-by-design approach to fully gain the trust of the future and existing digital payment adopters,” Connell adds.

To help users in APAC embrace digital payment technologies securely, Kaspersky experts suggest the following:

It is better to be safe than sorry – beware of fake communications, and adopt a cautious stance when it comes to handing over sensitive information. Do not readily share private or confidential information online, especially when it comes to requests for your financial information and payment details.

Use your own computer and Internet connection when making payments online. As like how you would only make purchases only from trusted stores when shopping physically, translate the same caution to when making payments online – you’ll never know if public computers have spyware running on them recording everything you type on the keyboards, or if your public Internet connection has been intercepted by criminals waiting to launch an attack.

Don’t share your passwords, PIN numbers or one-time passwords (OTPs) with family or friends. While it may seem convenient, or a good idea, these provide an entryway for cybercriminals to trick users into revealing personal information to collect bank credentials. Keep them to yourself and safeguard your private information.

Adopting a holistic solution of security products and practical steps can minimize the risk of falling victim to threats and keeping your financial information safe. Utilize reliable security solutions for comprehensive protection from a wide range of threats, such as Kaspersky Internet Security, Kaspersky Fraud Prevention and the use of Kaspersky Safe Money to help check the authenticity of websites of banks, payment systems and online stores you visit, as well as establish a secure connection.

To read the full report, please visit https://kas.pr/b6w8.

Methodology

The Kaspersky “Mapping a digitally secure path for the future of payments in APAC” report studies our interactions with online payments. It also examines our attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology.The study was conducted by research agency YouGov in key territories in APAC, including Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam (10 countries). Survey responses were gathered in July 2021 with a total of 1,618 respondents surveyed across the stated countries.

The respondents ranged from 18-65 years of age, all of which are working professionals who are digital payment users.

Through this study, when the behavior of the population of a market is generalized, it is in reference to the group of respondents sampled above.

COUNT

PH slides to top 4 in Kaspersky’s new global ranking of countries most targeted by online threats

February 5, 2024 9:46 p.m.

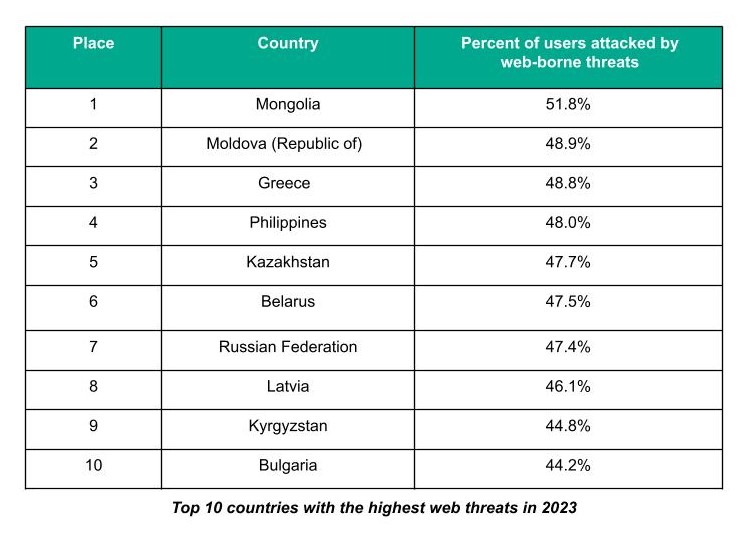

In 2023, web threats targeting the Philippines were about two percent less (48%) than in 2022 (49.8%), according to the latest Kaspersky Security Network (KSN) report.

With this new data, the country moved two spots down to fourth place worldwide among countries most targeted by malicious files from the internet and phishing websites. It looks like a positive development but Kaspersky is strongly advising against dropping the armor.

“There are two things that could explain the drop in web threats, albeit slightly. First is that we see the country is slowly making headway in cybersecurity. We classify the Philippines to be in the intermediate group of countries that are identifying cyberattacks and making efforts to implement rules. The second one and this we have to seriously take note, is that cybercriminals are continuously taking other attack routes that might be off the radar. One trend that we consistently have been seeing lately is their preference for targeted attacks instead of the spray and pray method,” said Yeo Siang Tiong, General Manager for Southeast Asia at Kaspersky.

“Complacency, however, is still not an option. Cybercriminals continue to develop their tools and techniques. They actually surprise cybersecurity experts all the time. Our mindset should be how to be able to hunt threats before they could cause harm and damage. At this point, I recommend that we should be talking more about threats as we proactively learn to detect and respond to them. This is where threat intelligence comes in handy,” added Yeo.

Web or online threats are attacks through browsers which are also cybercriminals’ tried and tested way to spread malware. It can easily be done with or without the involvement of the victim.

A web attack with victim participation is done through social engineering. The victim is tricked into doing something that jeopardizes their personal security or the security of the organization they work for. The objective is to get the victim to respond by clicking an infected email attachment, a compromised website, or responding to a fake unsubscribe notice, among others. Last year’s data breaches involving a government agency and an e-wallet company, which were each reportedly traced to phishing, are examples of this type of web threat.

An attack requiring no victim involvement is through drive-by downloads. By simply visiting a compromised website, their device gets infected automatically (and silently) particularly if they failed to apply a security update to one of their apps. This method is used in most web attacks.

In the recent global ranking, the Philippines came behind Mongolia (51.8%), Moldova (48.9%) and Greece (48.8%). Since 2019, the country has consistently been in the top 10 ranking countries.

Among Southeast Asian countries, the Philippines is trailed by Malaysia with the overall percentage of users attacked by web-borne threats from January to December 2023.

To stay protected, Kaspersky recommends users the following:

- Do not download and install applications from untrusted sources

- Do not click on any links from unknown sources or suspicious online advertisements

- Create strong and unique passwords, including a mix of lower case and upper case letters, numbers, and punctuation, as well as activating two-factor authentication

- Always install updates

- Ignore messages asking to disable security systems for office or cybersecurity solution

- Use a robust cybersecurity solution appropriate to your system type and devices

For organizations, Kaspersky recommends the following:

- Always keep software updated on all the devices to prevent attackers from infiltrating network by exploiting vulnerabilities

- Use strong passwords to access corporate services. Use multi-factor authentication for access to remote services

- Choose a proven endpoint cybersecurity solution for business that is equipped with behaviors-based detection and anomaly control capabilities for effective protection against known and unknown threats

- Use dedicated set of effective endpoint protection, threat detection and response products to timely detect and remediate even new and evasive threats

- Use the latest threat intelligence information to empower your security experts

COUNT

There’s a Nanyang near you for all your Singaporean food cravings

August 4, 2023 6:30 p.m.

Missing Singapore’s famous Hainanese Chicken Rice, Laksa fishball, Cheesy Chicken Chop Noodles and Kopi?

Visit your nearest Nanyang Philippines branch.

COUNT

Globe powers up TOYCON 2023’s landmark 20th year

June 29, 2023 6:53 p.m.

As Toycon Philippines proudly commemorates its 20th year, the landmark celebration promises to be more electrifying than ever with the formidable support of leading digital lifestyle brand Globe.

For the first time, Globe is the title sponsor of the iconic pop-culture event, bringing a new level of excitement and engagement to the toy collector and creator community.

Globe has always been at the forefront of supporting diverse subcultures and passions, and this partnership is a testament to its commitment. As part of the collaboration, Globe will bring to life the rich world of its cinematic and theatrical partners, further enriching the TOYCON 2023 experience for attendees.

“Globe is thrilled to collaborate with Toycon Philippines, especially on such a milestone year,” said Mike Magpily, VP, Head of Segment Strategy and Subcultures at Globe.

“As the country’s most reliable network and top digital solutions platform with an ecosystem of various services, we’re uniquely positioned to foster the vibrancy of the toy collecting and creating community. This partnership underscores our commitment to nurturing a wide array of passions and interests while ensuring the best connectivity for all participants.”

Cholo Mallillin, Marketing Head at Toycon Philippines, said: “The collaboration with Globe will further elevate the Toycon experience. This partnership will bring more surprises and rewards to our community. We invite everyone to join us as we celebrate 20 years of Toycon in the most exciting way possible.”

TOYCON 2023 will be held at the SMX Convention Center in MOA from July 7 to 9, 2023. Attendees are in for a treat, as they have the chance to meet their beloved childhood characters, explore an expansive marketplace of unique toys and collectibles, and participate in exclusive Globe activities.

One of the highlights of the partnership is a series of exclusive perks for Globe customers. By using Globe Rewards points, customers will have the opportunity to win various ticket tiers ranging from Day Passes to VIP Passes. There will also be exclusive toy freebies for VIP pass holders, and unique Globe-only activities, such as paint-your-own Gudi.

At the event, Globe will also host an interactive booth featuring activities designed to reward and inspire. From earning freebies by donating Rewards points to a good cause, to free arcade plays and meet-ups with popular streamers, Globe customers are in for an exciting weekend of gaming and beyond.

To keep up-to-date with all the exciting promotions and surprises at TOYCON 2023, Globe customers are encouraged to use the GlobeOne app.

To learn more about Globe, visit https://www.globe.com.ph/.